The renewable energy industry is facing an imminent worldwide glass shortage, with technology company Sunman expecting PV glass output to be 20-30 per cent short of demand in 2021.

The fall in production follows restrictions in China, where the majority of solar glass is made. The limitations have been imposed by the government in an effort to limit pollution due to the energy-intensive process of manufacturing glass. The shortage of supply risks having a knock-on effect for the booming green energy industry.

Most traditional solar panels utilise glass to protect the solar photovoltaic cells from potentially damaging external factors, with approximately 20 per cent of the cost of traditional solar panels being due to the glass. Given that the cost of the glass that coats photovoltaic panels doubled in the last half of 2020, many solar panel manufacturers are being forced to increase their prices to compensate.

The shortage comes as the solar industry turns toward bifacial panels, which use glass on both sides, thereby increasing both power output and glass requirements. Sunman predicts the demand for bifacial panels will make up half the market for solar panels in 2022.

Solar glass manufacturers requested permission from the Chinese Government to increase production to accommodate the shortage, but it will take some time to scale up. The shortage is easing due to capacity being tweaked, sales being delayed and reductions in revenue. Whilst it is anticipated that new capacity will come online, there will be a shortage of large panels throughout 2021 as production capacity will not be able to keep up with the increasing demand for modules.

It will also not address the issue of emissions or recycling as solar glass, due to impurities such as cadmium, lead and other chemicals, cannot be recycled at the end of its lifespan.

Dr Zhengrong Shi, Founder of Sunman and solar entrepreneur, said that manufacturing more glass will solve the shortage issue, but notes that it is still a very energy-intensive process, which creates pollution.

“The production of the glass-free e-Arc panel is less polluting as it is manufactured in a single step process to create a lightweight polymer composite material and does not require aluminium frames,” Dr Shi said.

The price issue has led to a 40 per cent increase in enquiries, particularly in South-East Asia and Europe, for Sunman’s innovative e-Arc modules. 70 per cent lighter than a glass panel and easier to install, they also avoid the use of aluminium which is an energy-intensive raw material used in making all glass.

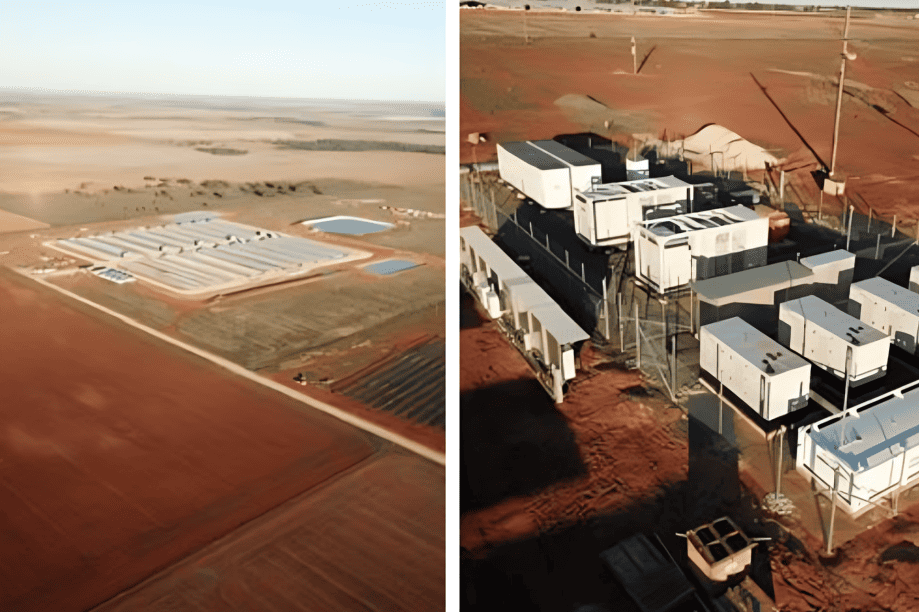

This allows the modules to be used across a wider range of applications as they can be installed across existing rooftops on factories, warehouses, garages, and other structures that are not strong enough to support heavier glass panels.

“The e-Arc modules are a cost-effective alternative to traditional solar as they are flexible and can be bonded to rooftops or other building surfaces such as facades. There is huge potential for commercial and industrial building owners to reduce their costs and lower emissions by investing in e-Arc solar,” Dr Shi said.

Many building owners are unaware that the payback period for investing in solar has plummeted over the past decade with the average period now down to 2.5 years. The investment costs can now be more easily offset against the immediate savings in electricity costs.

Last year, the Clean Energy Finance Corporation (CEFC) invested $7 million in Sunman to further develop the application of its e-ARC modules.