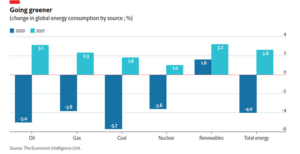

A new report by The Economist Intelligence Unit (The EIU) forecasts that energy consumption in 2021 will rebound partially, by 2.6 per cent, after contracting by an estimated 4 per cent in 2020. Consumption, however, will not return to 2019 levels. Upstream oil and gas producers are expected to reduce dividends and cut back on operational and capital spending.

The EIU expects investment to shift away from upstream oil and gas toward electric supply. Renewables will become a more attractive investment option, given new emissions regulations, priority on the grid and lower technology costs.

Additionally, recovery in coal consumption is forecast to be weaker than that for oil and gas, but much will depend on whether growth in coal demand in Asia compensates for the structural decline in coal use in the US and Europe.

Principal Analyst for Energy at The EIU, Peter Kiernan, said 2020 and 2021 will be lost years in terms of demand for the three fossil fuels – oil, gas and coal.

“Of the three, gas will be the least. Oil will take slightly longer to bounce back to the 2019 level, while coal is the most likely to have seen its peak,” Mr Kiernan said.

“Renewables, meanwhile, will suffer in the shorter term from a slowdown in investment and capacity growth, but will be more resilient to the impact of COVID-19.”

Climate-friendly approaches to economic growth are anticipated to dominate in 2021, but not everywhere. Of the three largest greenhouse gas emitters – China, the EU and the US – the EU is expected to make substantial progress towards achieving net-zero emissions by 2050.

A victory for Joe Biden in the US presidential election is slated to give the country renewed influence over global climate policy, but all eyes will be on China in the light of its recent announcement to target carbon neutrality by 2060. This is likely to fuel the growth in renewable energy, particularly in Asia, The EIU says.

The full ‘Industries in 2021’ report can be found here.