Partners Group has, on behalf of its clients, agreed to sell CWP Renewables, a vertically integrated renewable energy platform in Australia, to Squadron Wind Energy Assets.

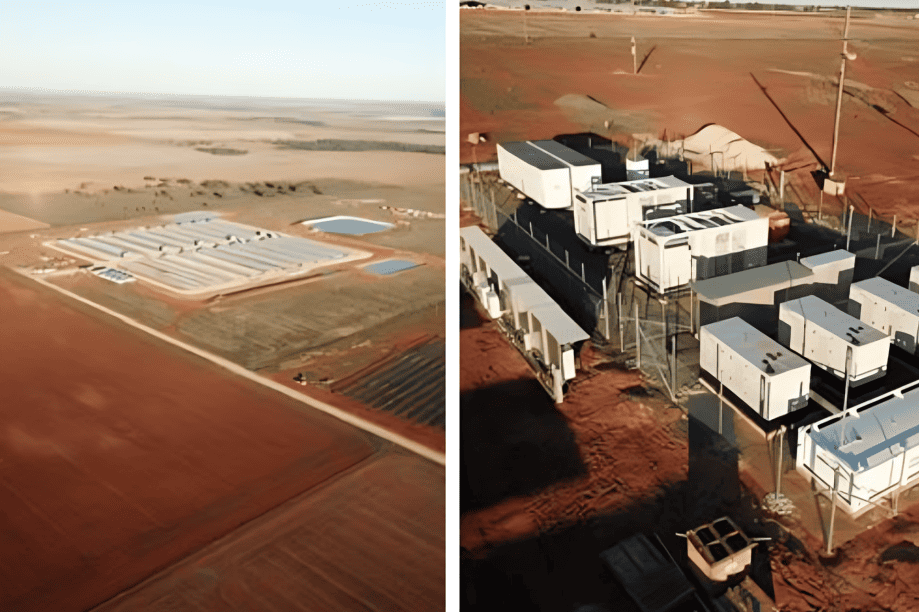

CWP’s renewable energy platform spans onshore wind and battery farms, and provides power to clients including Transurban, Woolworths Group, Sydney Airport, Commonwealth Bank, and Snowy Hydro. It currently operates over 1.1 GW of wind assets including Sapphire Wind Farm, which has 75 turbines generating up to 270 MW, Murra Warra I & II (with a combined 435 MW), Bango Wind Farm (244 MW), and Crudine Ridge (142 MW). CWP’s portfolio also includes a construction-ready 414 MW wind farm and a 30 MW battery project. The Platform has a project pipeline including 5 GW of near-medium term projects and an additional 15 GW at an early stage of development.

Partners Group developed CWP from the ground up in line with its long-term and thematic approach to investing in next-generation infrastructure assets that benefit from decarbonization trends. The firm invested in Sapphire Wind Farm, the first of the CWP assets to be constructed, in 2016. In building CWP, Partners Group successfully managed projects towards commercial operation dates, installed best-in-class teams to handle daily operations, arranged long-term power purchase agreements, and implemented a portfolio debt staple to replace individual asset specific project finance facilities, all with a view to the long-term sustainability of the Platform.

Martin Scott, Head of Australia, Partners Group, says: “We are proud to have built a major renewable energy platform that is set to play a key role in decarbonising Australia’s energy mix and supporting the country and its businesses in meeting their ambitious net zero ambitions.”

Andrew Kwok, Head of Private Infrastructure Asia, Partners Group, comments: “The Platform, including late-stage construction assets, creates enough energy to power 200,000 homes, employs more than 1,000 Australians, and avoids 2.1 million tonnes of emissions through its renewable power generation.”

Nick Kuys, Head of Private Infrastructure Asset Management Asia, Partners Group, adds: “The assets in the CWP platform benefit from talented operations teams and long-term contracts, which provide highly visible cashflows.”

Partners Group’s Private Infrastructure business has USD$21 billion in assets under management and has made over 130 investments in 18 countries globally. Partners Group has invested over USD 3.8 billion in renewable energy assets globally.