India has achieved a record-breaking surge in renewable energy installations, reaching 7.1 gigawatts (GW) in March, more than doubling the previous record set in March 2022, according to Rystad Energy’s latest data.

This growth has propelled India to its highest-ever annual installed capacity of 18.5 GW for the fiscal year ending on 31 March 2024.

The increase in installations was primarily driven by solar energy, which saw a 23 per cent increase compared to the 2023 financial year.

This growth was fuelled by the commissioning of numerous projects within India’s inter-state transmission system network and ultra-mega solar park schemes.

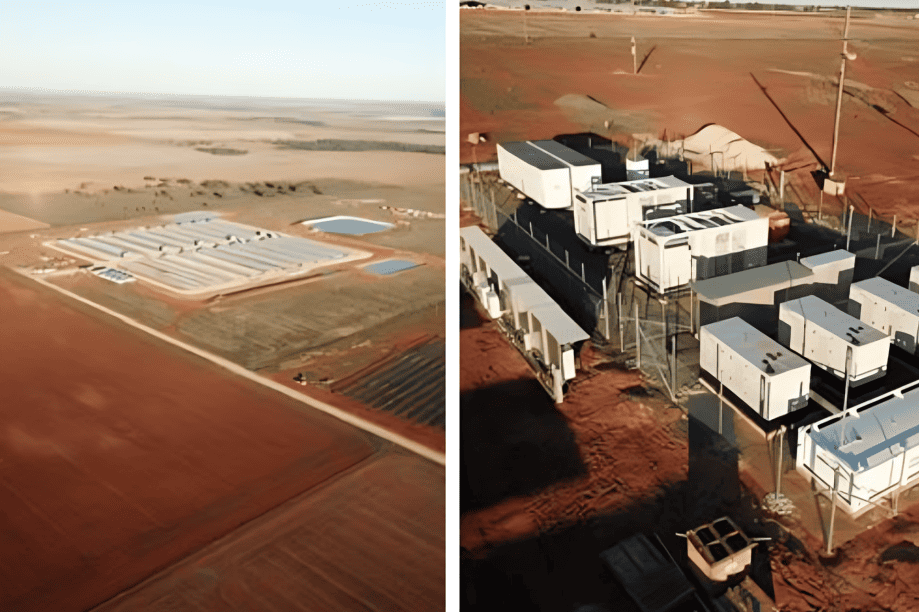

States such as Gujarat, Rajasthan, Madhya Pradesh, and Maharashtra played a significant role in this expansion. Notably, Adani Green, the renewable energy arm of the Adani Group, made substantial strides in the first quarter of 2024 by installing approximately 1.6 GW of solar capacity in the Kutch district of Gujarat.

This initiative is part of a larger hybrid renewable energy park that aims to install up to 30 GW of combined solar and wind capacity in Khavda in the coming years.

Despite the record growth in renewable energy additions, India faces significant challenges in meeting its renewable energy goals.

In early 2024, the Indian government advanced its renewable energy goal to achieve 500 GW of non-fossil fuel capacity by 2031-32, in line with Prime Minister Modi’s vision of a self-sufficient India aiming for net-zero emissions by 2070.

To achieve this target, India must install around 30 GW of non-fossil fuel energy generation capacity annually, including solar PV, hydropower, onshore wind, and nuclear energy.

The ramp-up of solar installations in India has created substantial demand for solar equipment, leading to a shift towards domestic manufacturing to meet local demand.

India has looked to expand its reach by exporting solar panels, with the US emerging as a major export destination.

However, Indian manufacturers face stiff competition from their Southeast Asian counterparts, who maintain an edge by utilising material inputs from China, resulting in lower costs.

India’s focus until 2032 will likely revolve around meeting ambitious domestic targets, with minimal short-term impact on accelerating energy transition beyond its borders.

The realisation of India’s potential in renewable power trading with neighbouring countries and beyond is not slated until the 2030s due to the capital-intensive nature of interconnector projects.

Rohit Pradeep Patel, vice president of renewables and power research at Rystad Energy, emphasised the importance of maintaining the fervor witnessed in recent months to achieve ambitious climate goals while ensuring grid stability and managing integration costs associated with introducing more renewable capacity.