Global commercial vehicle electrification is on the cusp of exponential growth, largely driven by climate policy and decarbonisation goals.

Wood Mackenzie outlines that government funding and zero-emission vehicle regulations are strong drivers for commercial electric vehicle (EV) adoption in every region thus far, therefore reducing the primary barrier to commercial EV adoption: cost.

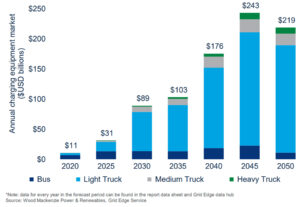

This policy support is expected to see the annual market value of electric bus and truck charging outlets pass the $200 billion mark by 2045.

Annual global commercial vehicle charging equipment market value, 2020 – 2050.

Though the sector’s annual market value is expected to hit $243 billion in 2045, the following five years will see a decline of almost $25 million.

Wood Mackenzie’s research points out that annual charger installations will increase throughout the forecast period, rising from 200,000 in 2020 to over one million in 2050, however, a shift towards higher-powered charging, development of public charging networks for trucks or on-route charging for buses, and more efficient fleet management strategies will result in fewer chargers needing to be installed in 2050.

Wood Mackenzie Research Associate, Kelly McCoy, said in the broader context of EVs, it is important to pay attention to how the commercial charging segment evolves.

“Stakeholders are collaborating and being more proactive than they were in the passenger EV segment to develop new charging strategies, products and solutions,” McCoy said.

“For example, utilities and grid operators concerned with impacts on the local distribution grid are engaging fleets in pilots and offering EV-specific rates, including greatly reducing or freezing demand charges. Additionally, fleet operators are actively pursuing integrating EV charging with other on-site distributed energy resources and their building loads to minimise electricity demand.”

She said commercial EV fleets are excellent resources for vehicle-grid integration, as they have fixed routes and schedules and remain parked for most of the day.

“Not every region prioritises vehicle-grid integration, but it has the potential to increase resiliency and reliability on distribution grids in particularly vulnerable regions, such as India.”

According to Wood Mackenzie, China currently dominates the electric bus and charging infrastructure landscape. In 2020, the country had more electric buses than any other region will have in 2050. By mid-century, there will be six times as many electric bus charging outlets installed in China compared to the second-largest market, the United States.

McCoy shared that it is common in China for bus fleet operators to pay a third party to install, operate and maintain the e-bus charging infrastructure.

“Early data shows that the infrastructure partner will break even from the initial investment in five to six years. This model is being explored in other regions, and could encourage EV adoption by reducing cost, technical barriers and administrative burdens on fleets as they electrify,” she said.

Wood Mackenzie notes that commercial truck charging will largely take place in three locations through 2050: depots owned or operated by the fleet operator, destinations such as warehouses or ports, and public charger networks along transit corridors.

The first two solutions are already being developed, but public commercial vehicle charging networks will need to be built in order to support long-distance transit and freight vehicles.

Though light and medium truck installations are underway across the globe, heavy truck electrification is not expected to reach every market until 2028. By the end of the forecast period, this segment is expected to only grow to 3 per cent of commercial outlet installs.

Though lagging behind its global counterparts, India will have installed 41 per cent of the world’s heavy truck charging outlets in 2050 due to India’s use of different truck weight classifications compared to other regions.