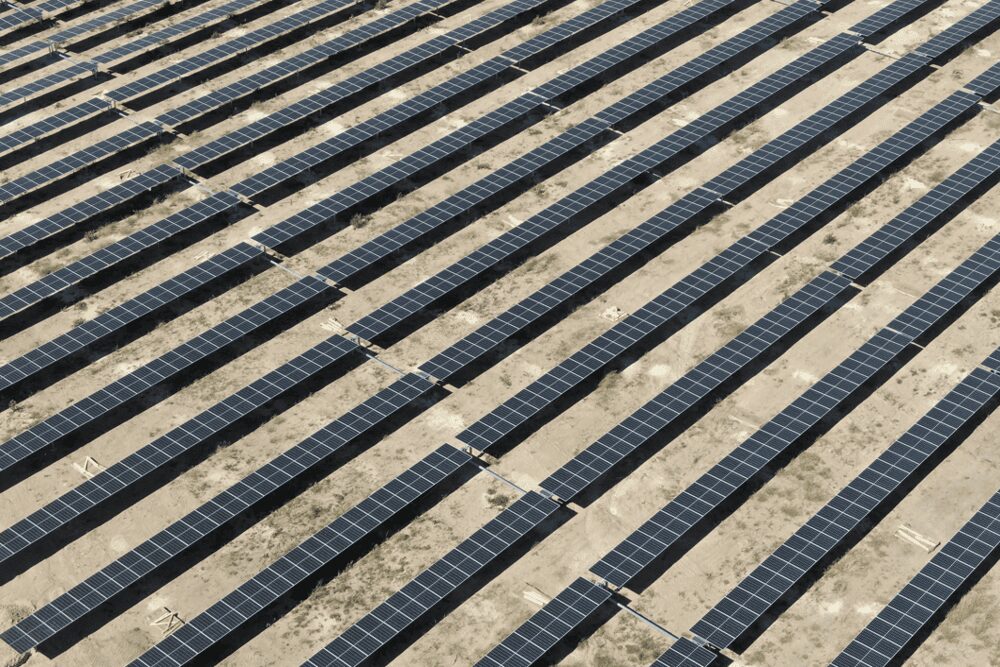

In 2023, Europe witnessed a remarkable expansion of 60 gigawatts of direct current (GWDC) in solar PV capacity, yet solar power generation only saw a modest uptick of about 20 per cent.

However, 2024 is poised to tell a different story, with Rystad Energy forecasting a substantial spike of approximately 50 terawatt-hours (TWh) in solar PV energy.

This surge, the largest among all generation sources, is attributed to major capacity installations across the region, with Germany leading the charge.

Germany, which transitioned from a major electricity exporter to a net importer in 2023, is expected to maintain its lead in the European solar power market in 2024.

This shift was driven by various factors including the closure of nuclear power plants, lower solar energy generation, and the availability of cheaper electricity from other markets.

To secure energy security and reduce reliance on imports, Germany increasingly turned to imports from France and Denmark.

The growth of solar PV in Germany was particularly notable in 2023, with over 14 GWDC of new capacity added, mainly through the installation of rooftop PV systems.

Residential rooftop installations accounted for 6.5 GWDC, powering around 1.3 million households annually.

Additionally, the commercial and industry (C&I) sector saw 3.5 GWDC of installations.

Rooftop installations played a pivotal role in Germany’s solar PV growth, with over 70 per cent of the added capacity coming from this segment.

Looking ahead, renewables are expected to continue their strong growth trajectory in 2024, with solar leading the way in both capacity and generation.

This, coupled with more stable output from nuclear generation, is projected to further reduce fossil fuel demand for power.

Rystad Energy Head of Renewables & Power EMEA Research Vegard Wiik Vollset stated: “As the demand for power in Europe is only growing slightly, we can conclude that Europe is fulfilling its electricity demand growth entirely with renewable sources.

“This indicates that the growth of renewable energy is more than sufficient to cover the growth in demand, which is why we are observing a decline in the use of fossil fuels.”

While wind power generation is expected to increase by 38 TWh in 2024, the anticipated capacity additions fall short of what is needed for Europe to meet its ambitious decarbonisation targets.

Despite plans by EDF, Europe’s largest nuclear power operator, to increase output after resolving issues in 2023, nuclear generation is expected to be lower than pre-2022 levels due to decreasing capacity.

Fossil fuel generation is also expected to fall in 2024, although at a slower rate than in 2023, as total power demand in Europe rises somewhat.

The cost competitiveness of coal and gas plants will determine their relative balance.